Boulder Legal Group, LLC is a Debt Settlement firm. A recent arbitration case was filed against them by an Alabama couple alleging that despite paying the debt settlement company thousands of dollars to settle some credit card debts, they were sued by Discover Bank and then abandoned by Boulder when they needed them most.

My clients hired this debt settlement company back in October of 2016 to help resolve some credit card debts. When they signed up with Boulder Legal Group, they were told that they would be protected from collection lawsuits, and that if any collection lawsuits were filed against them, the debt settlement firm would help defend them from the lawsuit. So they agreed and signed a contract, believing that Boulder Legal Group was a legitimate law firm who would actually defend them if their creditors sued them.

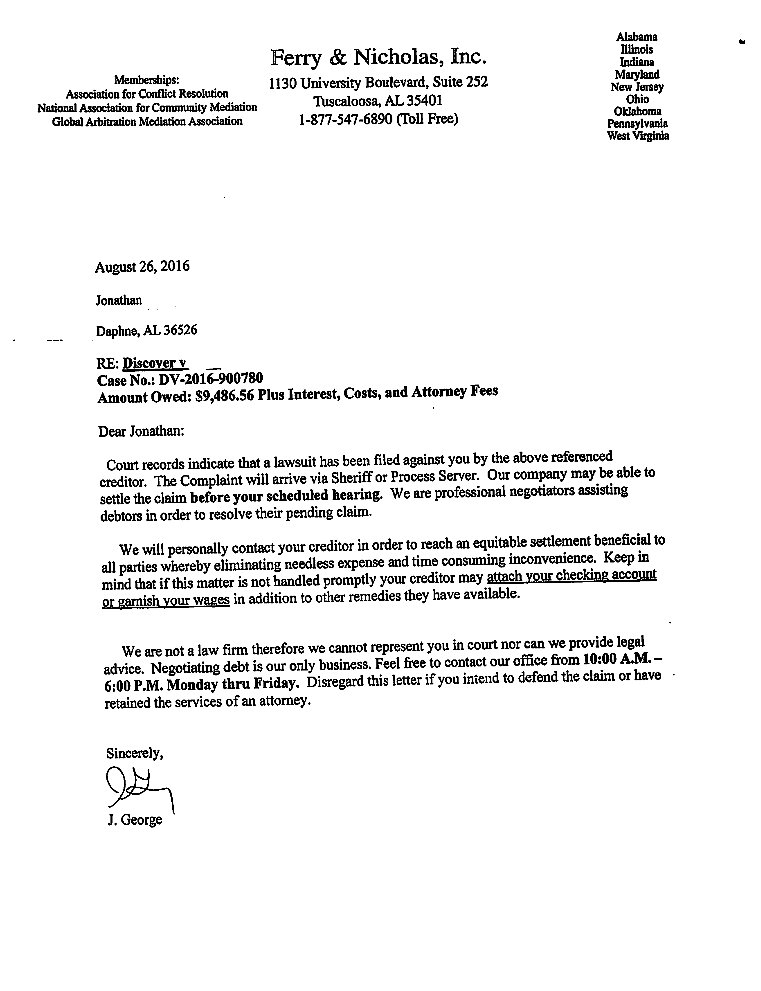

According to the Complaint, the couple made steady payments to this debt settlement firm for months, paying them well over $10,000. But sure enough, they were sued by Discover Bank for one of the credit cards that they had included in their debt settlement program. They notified the debt settlement company, and expected some legal defense. But no attorney ever appeared in the lawsuit or filed an answer for them. So a default judgment was entered against them for over $12,000. Soon after that, a garnishment was filed with the court for the garnishment of the husband’s wages. Neither Boulder Legal Group nor any attorney associated with them filed anything to stop the garnishment, to defend the lawsuit, or to prevent Discover from obtaining a judgment against them.

So they came to us. Like all predatory contracts, the agreement they signed with Boulder Legal Group contained a mandatory arbitration provision and class action waiver, which was designed to prevent consumers from getting their cases to court. We filed an arbitration case against Boulder Legal Group, the Law Offices of Camron Hoorfar (an attorney associated with Boulder), and Global Client Solutions, LLC (the payment processing company used by Boulder Legal Group).

The arbitration demand alleges that Boulder Legal Group and its attorneys committed legal malpractice by failing to provide any defense whatsoever when our clients were sued by Discover Bank. It also alleges that Global Client Solutions, LLC violated the Electronic Fund Transfers Act by failing to send written statements to our clients, which prevented them from ever seeing where their money was going.

If the arbitration is successful, we should be able to obtain a court judgment against this debt settlement company, putting a public record out there for the information of anyone else who may find trouble from this company.

Debt Settlement companies are almost always scams. I’ve never encountered one that has done a good job for their clients. As an attorney, I am disgusted by out-of-state lawyers who fool people into paying good money for what they believe to be bona fide legal representation. If you are considering hiring a debt settlement company, don’t. Talk to a real, local lawyer today.